The long awaited Insight Data 2014 Window Industry Report has been published, and there is some very interesting details that are worth reading up on. This is a quick overview of the report, taken from the Insight Data website. I’ll be writing about by initial thoughts in this post, and over the coming days delve into a few more of the specific details as some of the information contained in the report makes for some very interesting reading.

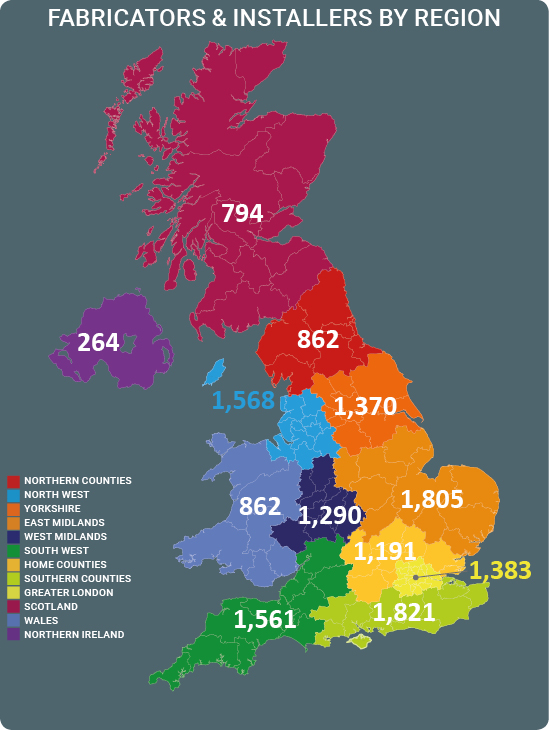

Fabricators & installers

According to the report, there has been a net increase for the Northern Counties, the Southern Counties remains the hot spot, with Northern Ireland, Scotland and Wales lagging behind in three-figure territory. At first glance, there probably appears to be an oversupply of companies compared to the amount of business out there. Hence the flurry of acquisitions and takeovers in the past few years.

Fabricators per region

The East Midlands reigns supreme in terms of numbers, with Yorkshire close behind. Compared to the 2013 report, the number of PVCu fabricators has dropped by 88, aluminium dropped by just 5 and timber by 9. Although as the image suggests, there are some companies fabricating more than one material. The drop in PVCu numbers is a telling sign of stronger diversification within the industry.

PVCu fabricators

Compared to the 2013 report, this chart shows a 2% drop for the fabricators making 1-100 frames per week, a 1% rise for the 101-500 frames per week companies, and a 1% rise for those in the 501+ frames per week bracket.

The drop in the 1-100 frames per week isn’t a surprise. As rising manufacturing costs continue, it becomes less and less profitable to produce frames in such small numbers. I do wonder how long this low level of fabrication can continue, given rising costs and pressures from the larger fabricators.

PVCu fabricators in decline

There is good and bad in this chart. At first glance the general state of PVCu fabrication doesn’t look too healthy. A decline of 836 fabricators is a very steep drop. But the average number of frames being produced per company has increased. So as other fall by the wayside for one reason or another, the remaining companies get to increase their market share and pick up the extra business. So having the ability to stick around is rather important at the moment.

It’s also telling that the decline was during the recession. These big economic shocks have a habit of cutting out the least profitable or sustainable companies. Also, it’s widely regarded that there were far too many fabricators around to service the very quickly declining levels of business.

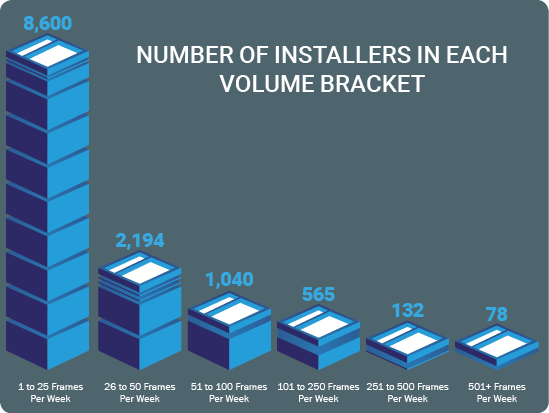

Number of installers

According to the report, the number of installers in the UK market has increased. A sign that profitable business is back, or people think it’s safe to get back in the water?

Clearly there are more very small installers than any other type combined. For me, the new FENSA Pay As You Go Scheme comes to mind. They said that the new scheme is for companies that infrequently install windows. Is one or two per week infrequent enough? If so, there are going to be a lot of infrequent window installers going to need their PAYG scheme.

More showrooms

Despite the power of the internet, the number of showrooms has steadily risen over the past few years, and in 2014. This is a positive move for the industry. As great as the internet is, it will never be able to give homeowners a real impression of the product, or how it feels in the hand so to speak. The showroom remains, and always will do, one of the most powerful sales tools in an installation company’s armoury.

Installers of sash windows

This didn’t really come as a surprise to me. The rise in installers fitting sash windows has been very obvious, and there has been a clear uplift in the number of homeowners actively searching for sash windows. I fully expect the 2015 market report to show that the number of installers fitting sash windows will have broken the 8000 barrier.

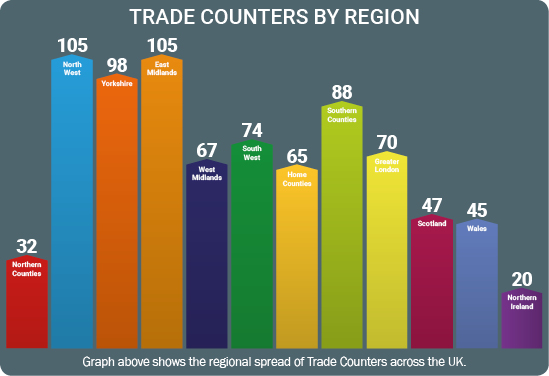

Trade counters by region

Described as a “disruptor” in the report, the popularity of trade counters continues to grow. Their convenience for trades people and easy profitability for suppliers means their rapid growth continues. But it does throw up some rather fundamental questions about the business model, considering the new legislation, laws and practises that have come into force over the past couple of years. That is a post for another day.

Other key stats

- Over 22,000 local builders now offer windows, doors and conservatories – up from 20,651 in the 2013 report. Installers may well see this as a threat, or at least a hindrance. An issue I will explore on DGB over the coming days.

- 455 new companies were added to the data, with 819 removed. The 819 removed was due to either closure or retirements. The issue of retirements is going to become more important I feel as the industry still struggles to bring in fresh faces to take over from those leaving the industry.

These are just my initial reactions and observations from the 2014 report. Over the coming days and weeks I’ll be delving deeper into the report to dig up some of the issues we should be paying closer attention to. A big well done to Insight Data for compiling such a report, and for free as well. With data and information so readily available these days, I find it archaic that other reports should be so expensive to buy. So kudos to Andrew and Insight for making this report free for people to read.

Click here to read the full Insight Data 2014 Window Industry Report

Click to expand infographic to full size

To get daily updates from DGB sent to your inbox, enter your email address in the space below to subscribe:

[wysija_form id=”1″]