The fenestration industry isn’t exactly littered with companies that are traded on the markets. But there are a few, and those few are key indicators as to the general health and outlook for the rest of the industry. So they are always worth a look.

As we near the half point of the year this feels like a good time to take a look at our stock market listed companies and how their share price has performed over the last 6 months.

An overview

Here are some of our main traded companies and how they have performed so far this year:

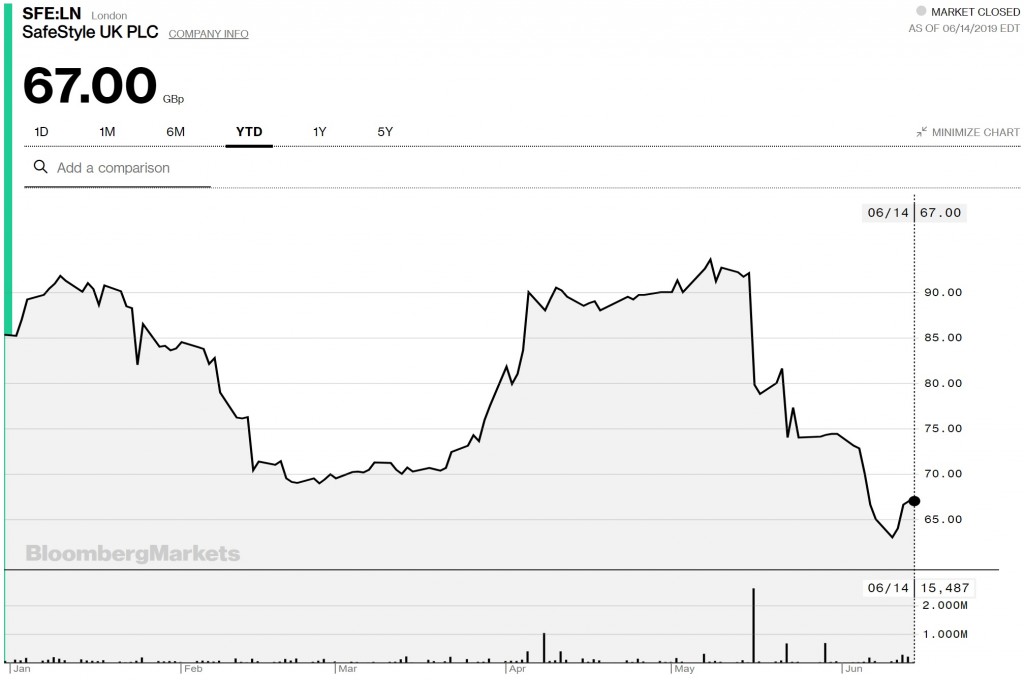

The company with the most attention on share price in the past couple of years has been Safestyle, for one reason or another. At the start of the year their share price took a dip, recovered again and has since dropped to lows last seen near the end of 2018. Their share price is a mile away from their thirty-odd pence lows when they were going through the height of their problems. They’re also still a very long way from their 300p+ highs from a couple of years ago.

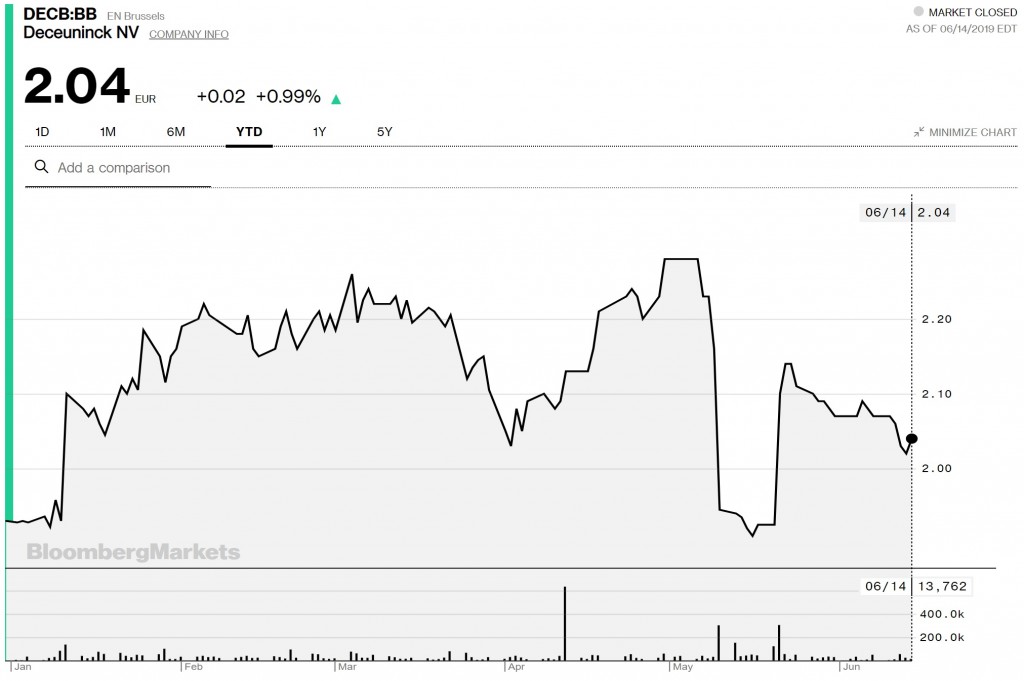

Deceuninck are having a fairly steady year so far. They had a gradual upwards trajectory up until a rather dramatic fall in May, recovering somewhat in June. Deceunick shares aren’t prone to huge swings however, so whilst that vertical drop looks dramatic, it’s still within a narrow range over a longer period of time.

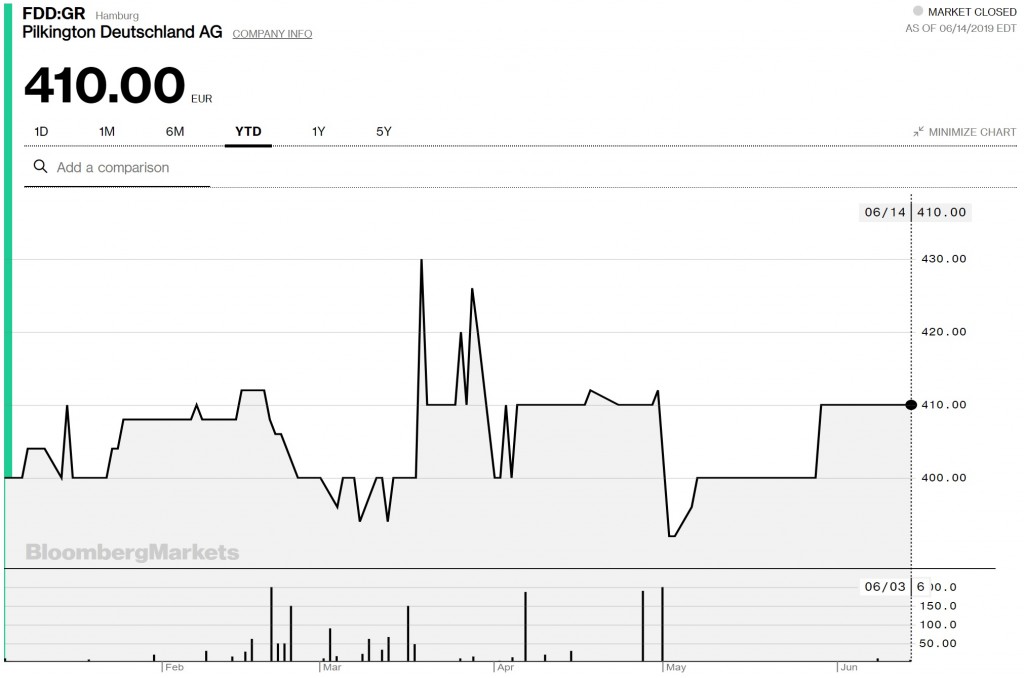

Pilkington’s chart might look a tad dramatic, but their traded volumes are low and the prices swings you see on their chart are all within a 35 range. It’s worth noting that their share price has tended to trade within this range for the past four years. They’re well shy of their 2015 highs which saw them nearly reach 500.

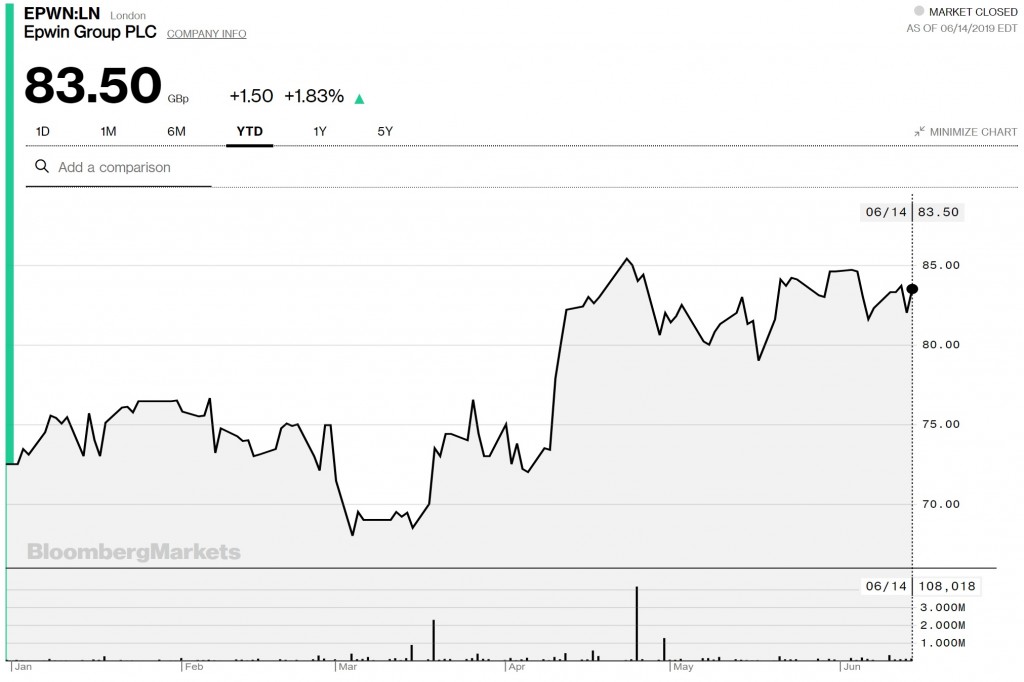

Epwin’s shares are the ones that get the gold star out of these six. After a fairly timid start which saw their value drop below 70p, they have since staged a solid comeback to breach the 85p mark and stay close to it ever since.

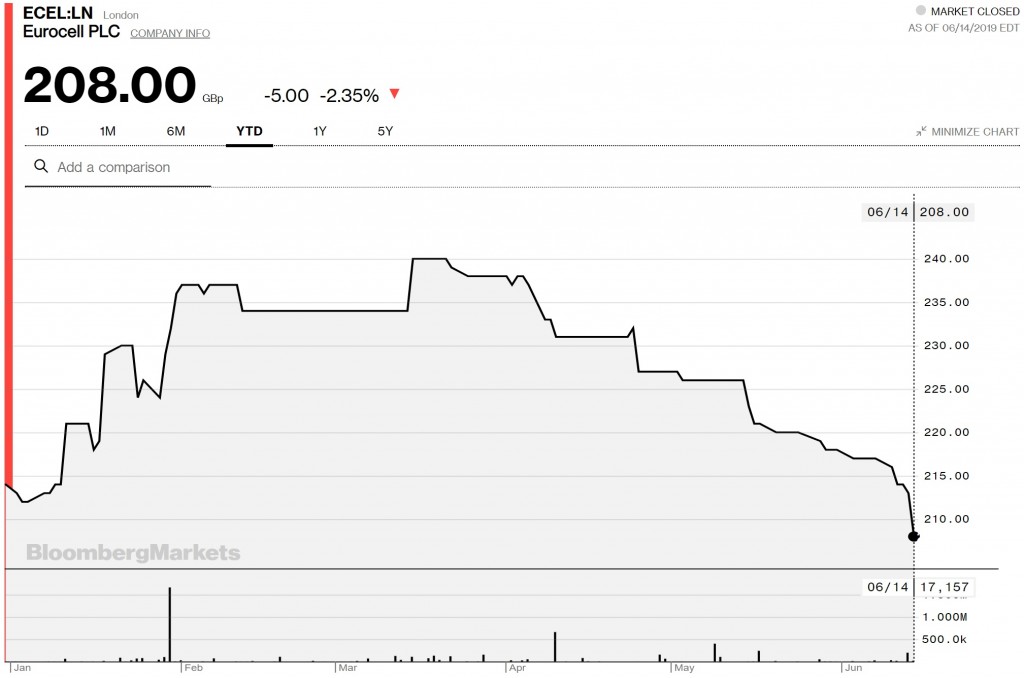

Eurocell, like others on this page, started well with a nice solid upwards trend. Then spring came and that ground was given up and now their price sits slightly below where they started at the beginning of the year. If you take a longer term view of their share price performance, they have traded within a 60p range since 2017, and they are still well above their lows of 135p in mid-2016. After a solid 2018 and strong growth plans for 2019, they will be hoping that they can recover some of that gained ground.

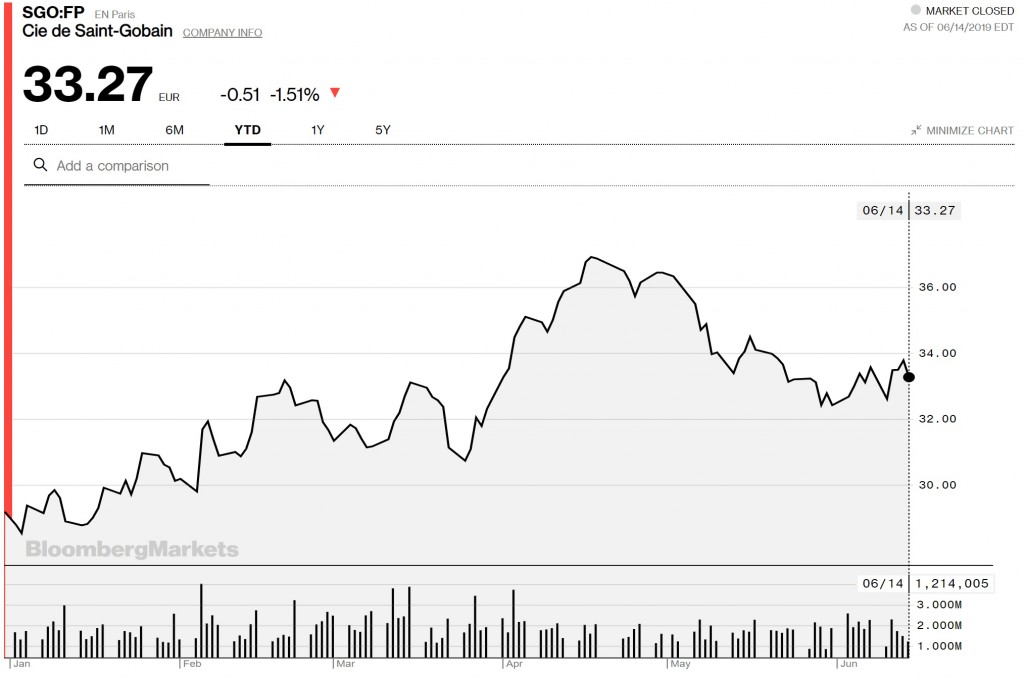

Saint-Gobain, like the rest, had a decent start to this year, with a gentle upwards trend. Then, as with others, spring came and a lot of that ground has been lost. It’s worth noting that since reaching their 2017 high of 52.28, they haven’t been near to that figure since. It’s been a steady decline to the 30’s range and has been there a little while.

So, on the face of it, nothing here is really that exciting. All had decent starts, with only Epwin Group able to maintain the ground it kept. All others had run out of steam by Spring time. That being said, as with all shares traded on stock markets, they are sensitive to big global changes in economic environment, and the rest of the world, with America soon to follow, is slowing down. These companies all seem on solid footings for now, so the fact that five out of six of these have found a downwards trend may well be more to do with external global factors rather than their own fortunes.

Overseas

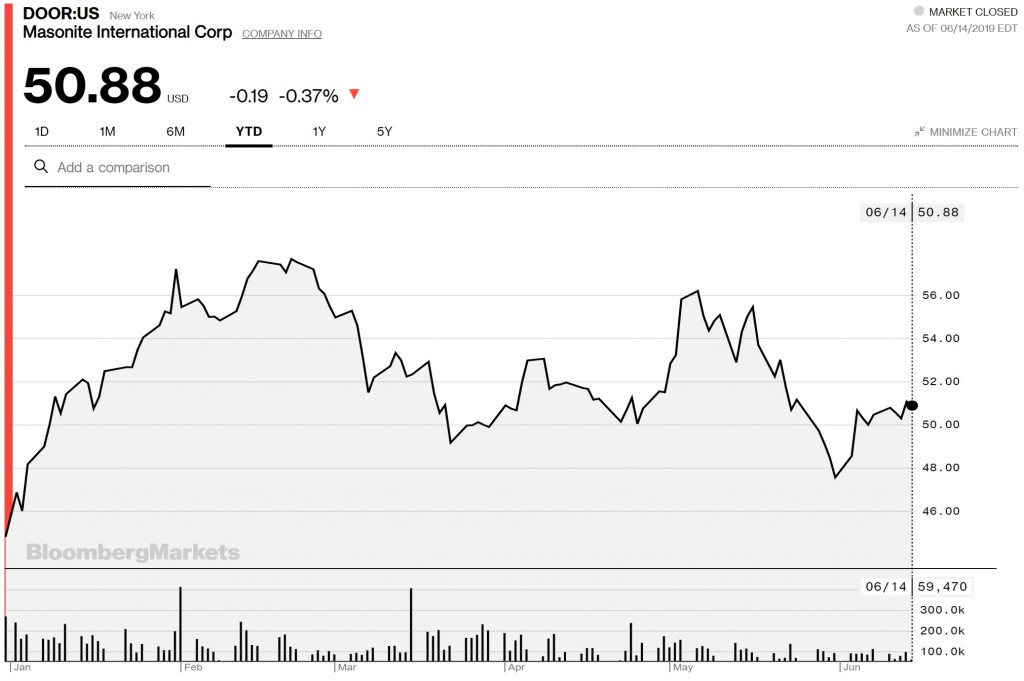

It’s also worth taking a look at two overseas companies with UK interests; Masonite and Masco. US based Masonite own two UK based composite door heavyweights in Door-Stop International and Solidor. Also based in the US, Masco own the UK Window Group. The UK Window Group is made up of; Duraflex, UK Fabrication, Phoenix Doors, UK New Build, Seven Day and Evolution.

The picture here is very much like the European picture. Ground gained then given away as Spring comes and volatilty spikes. Masco is currently undergoing a review of their window and cabinetry businesses, which may well have a direct impact felt in the UK.

We can use these charts to help paint a picture as to the general feel and performance of the window industry as a whole. As we reach half way through the year, I would sum things up as steady. There’s nothing here to say things are booming, but also nothing to say there’s imminent danger or something dramatic on the way.

As we reach July, earnings season will hit for some of these companies, which may or may not have an impact on their share price performance. So something to keep an eye on as we go into the second half of the year.

To get weekly updates from DGB sent to your inbox, enter your email address in the space below to subscribe:

By subscribing you agree to DGB sending you weekly email updates with all published content on this website, as well as any major updates to the services being run on DGB. Your data is never passed on to third parties or used by external advertising companies. Your data is protected and stored on secure servers run by Fivenines UK Ltd.